-

Posts

938 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Everything posted by EatBulaga

-

No idea what to include in I-751

EatBulaga replied to Bev75's topic in Removing Conditions on Residency General Discussion

Do you already have a conditional green card? If yes, then follow the I-751 guidelines from USCIS "Checklist of Required Initial Evidence (for informational purposes only)" https://www.uscis.gov/i-751 and VJ guidelines for I-751 https://www.visajourney.com/guides/removing-conditions-permanent-residency/ and follow USCIS Form Filing Tips https://www.uscis.gov/forms/filing-guidance/tips-for-filing-forms-by-mail -

Trump's views on immigration

EatBulaga replied to Mark24's topic in General Immigration-Related Discussion

Too early to notice any change to the USCIS processing times. Current USCIS processing times for K1 can be 8-12 months plus consulate process times. https://egov.uscis.gov/processing-times/ But VJ members reported Timeline data are at https://www.visajourney.com/times/k1-fiance-visa-historical/ -

Part 2, Item 11, is the beneficiary’s mailing address. Part 2, Item 12, is the beneficiary’s physical address history for the last 5 years. Part 2, Item 13, is the Date From and Date To: PRESENT, of Item 12 physical address. Part 2, Item 14-15, is the previous physical address history if the beneficiary changed address within the last 5 years, and include the Date From and Date To. If the beneficiary has had more than 2 physical addresses in the past 5 years, then continue in Part 8, additional information by listing Page Number: 5, Part Number: 2, Item Number: 14-15. If Item 11 and 12 are the same, then yes type in the address again, and include Item 13 the Date From with the Date To: PRESENT. Some country's locales may have different mailing to physical address because their mailing system may or may not deliver to the physical address, but will deliver to the mailing address. The K1 visa will be mailed to the Item 11 address, unless the beneficiary reports an address change.

-

Yes, very important to get the Social Security Card as soon as the I-94 is available. I do NOT recommend getting the SSC with the EAD or AOS, because of your exact situation. One rule that I advise all K1-to-AOS'ers is to get as much done within the 90-days or before the I-94 expiration, especially for name changes. Complete as many name changes as possible because most institutions recognize the I-94 and passport over the I-485 NOA1: SSN, State ID/driver's license, bank account, utility bills, healthcare cards, etc. That is not to say all those evidences need to be included in the AOS. I believe a good target for AOS is to file the I-485 within the first 30-days, and to spend the next 60-days streamlining the co-minglings or name changes. This is not a hard-and-fast rule, but it is a good goal to make the process smooth and have enough time to react in case life unknowns pop up.

-

July 2022 - AOS Filers

EatBulaga replied to Elmkiety's topic in Adjustment of Status Case Filing and Progress Reports

I-751 sent and received. I'm at the other party now. Good luck everyone! https://www.visajourney.com/forums/topic/828150-i-751-january-2025-filers/page/5/#findComment-11038928 -

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

Alrighty then! Time to join the party! 2025-01-22: I-751 Remove Conditions sent via FedEx 2025-01-23: I-751 received/signed Elgin, IL -

@Demise first block by a federal judge for 14 days. https://www.cnn.com/2025/01/23/politics/birthright-citizenship-lawsuit-hearing-seattle/index.html I suspect more legal back and forth will continue until it reaches the Supreme Court. Keeping the issue in the political conscious could lead some states or Congress to propose amendment to the Constitution. But will there be 2/3 majority in Congress and 3/4 majority of states may be the question?

-

@smilingstone @Edward and Jaycel AOS should include a copy of the marriage certificate, not the marriage license. If you only include the marriage license with your AOS, you risk getting an RFE for the marriage certificate. Marriage license is what you apply for before the marriage to get the officiant to sign and submit to the county clerk to register your marriage. Some marriage license have a line for you to request to the officiant to make a name change. Marriage certificate is the official record from the county clerk for the marriage. If you have a name change, you can use the marriage certificate to change your name at the Social Security office, driver's license office, etc. One thing often overlooked in preparing for the AOS is the wait time from the marriage to actually getting the marriage certificate. Some county clerk marriage registration may take over a month to get the marriage certificate, while others can be available the same day the officiant submits it. What I've observed in some cases is the marriage certificate wait is too long and the AOS is sent in with the marriage license before the I-94 expires to get the NOA1, but to only later receive an RFE for the marriage certificate.

-

Reporting Freelancer employment on I-130A

EatBulaga replied to hzlf's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

What earnings documentation or tax assessments does Canada require of you to tax your earnings? You won't need to worry about US taxes until you get a Social Security Number. Beneficiary’s job description is not as important as the petitioner's job description to prove financial support for I-130. Without more documentation, you can just label yourself something like "freelance contractor" (if you work by contract) or just "freelance services" unless you have earnings documents or tax assessments with more specific job labels? -

Reporting Freelancer employment on I-130A

EatBulaga replied to hzlf's topic in IR-1 / CR-1 Spouse Visa Process & Procedures

Do you have 1099s or W2s from each of your freelance jobs? Do you have IRS tax transcripts from the past 3 years? -

REAL ID when traveling

EatBulaga replied to MrsAb2021's topic in Working & Traveling During US Immigration

@MrsAb2021 Yes, the ROC foreign spouse can travel domestically and internationally with a green card, extension letter, and passport. You book the ticket with the passport but upload the green card and extension letter for US entry documents. REAL ID or REAL ID driver's license is more convenient for domestic travel since it is just 1 card vs 3 documents. -

Address Doesn't Fit I 129f

EatBulaga replied to Nates4Christ's topic in K-1 Fiance(e) Visa Process & Procedures

I've never done this, but you could handwrite to type in 11.b or 12.b to "see Part 8". then in Part 8, list Page Number 5, Part Number 2, Item Number 11 or 12. Then, you can type or handwrite in as needed. But you should be fine if you just list the address in Part8. -

Address Doesn't Fit I 129f

EatBulaga replied to Nates4Christ's topic in K-1 Fiance(e) Visa Process & Procedures

You can: 1. Handwrite in any fields in Part2. I've seen others in the past handwrite in Arabic, Thai, Vietnamese, etc. 2. In Part8, list Page Number 5, Part Number 2, Item Number 11 or 12. Then, you can type or handwrite in as needed. For 11.b or 12.b, complete the street number and name as needed. You can spill over to 11.c or 12.c as needed to fit the local address format. Remember the beneficiary’s address is where the K1 visa will be sent but some embassies/consulates allow for pickups at the embassies/consulates. Also, some embassies/consulates will notify you of their courier services when it is time to deliver, and you can arrange with the courier services about the delivery or pickup. -

https://www.whitehouse.gov/presidential-actions/2025/01/protecting-the-meaning-and-value-of-american-citizenship/ With all the speculations about the revoking of birthright citizenship order of the 14th Amendment, the above link has the actual verbiage. Does anyone have any ideas about the interpretation or how this will affect the current USCIS policies?

-

https://www.whitehouse.gov/presidential-actions/2025/01/initial-rescissions-of-harmful-executive-orders-and-actions/?fbclid=IwY2xjawH9Hh9leHRuA2FlbQIxMQABHV7tDsO56tl6daz71FamiDTayzJfzsYFSpieyOfCnOh3l_D9jY0mdWe-Ww_aem__rGWcGlWA2vvN2TK8lVkxQ There are discussions on FB that EO 14012 reinstates the 2020 civics test (instead of the 2008 civics test) for naturalization. The archived 2020 civics test can not be found here. https://www.uscis.gov/citizenship/2020test Anyone know where to find the 2020 civics test?

-

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

Thanks. But we don't have the online account number in NOA1 or NOA2. The online access number was sent in an email separately to us, but it was a 1-time use code. -

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

Thanks. I did not realize G-1145 is not submitted with the I-751. Where did you find your USCIS online account number? I could not find our USCIS online account number in the https://my.uscis.gov/ login? https://www.visajourney.com/forums/topic/827933-how-to-find-the-uscis-online-account-number-in-myuscisgov/ -

I-751 January 2025 Filers

EatBulaga replied to Qui's topic in Removing Conditions on Residency General Discussion

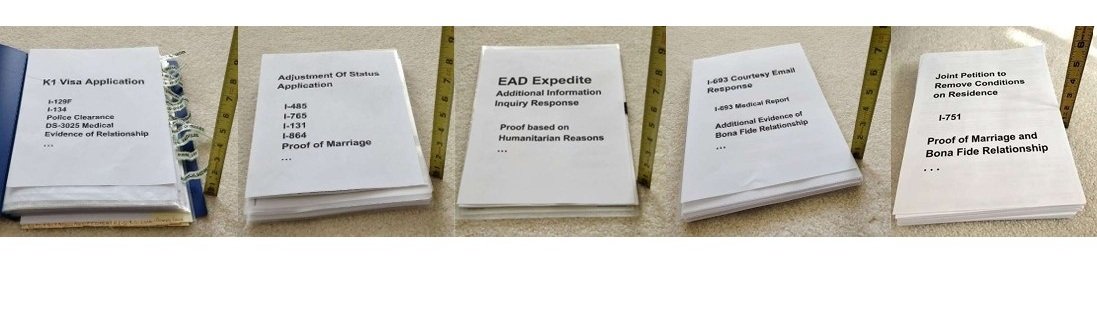

Greetings all, I'm anxiously awaiting to join the January 2025 filers club. My cover letter and evidence list look like https://www.visajourney.com/forums/topic/827917-what-do-you-think-about-this-cover-letter-i-751/ Any feedback is welcome. I will probably send the I-751 package out sometime next week. I'm just trying to make sure all the i's are dotted and t's are crossed 😂 -

@Sm1smom I think you mean USCIS sends the Online Access Code which is different from the Online Account Number. The Online Access Code is sent along with the NOA1 after the I-485 is received so the applicant can track the status. I did see the Online Account Number somewhere at one point, but can not find it now, or forget where it was used? @OldUser I appreciate your response, but apparently, the Online Account Number does not show up in our my.USCIS.gov. So the question now is the Online Account Number ever used or what is its purpose? Why would the forms I-129F, I-485, and I-751 ask for it if it is optional?

-

Invoice ID

EatBulaga replied to arg316's topic in K-1 Fiance(e) Visa Case Filing and Progress Reports

Invoice ID is from NVC. The consulate might have it as well?