benjii

-

Posts

18 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Posts posted by benjii

-

-

Hi there,

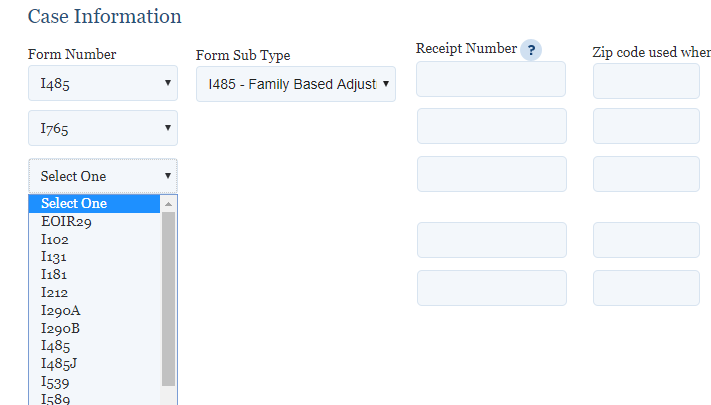

I have just moved and trying to update my address online.

I need to update the address for I-485, I-130, and I-765.

However, when I select I-485, then in the next row, there is no option to choose I-130. When I select I-130 first, then form I-485 doesn't show.

Am I missing something here? 😳

-

9 minutes ago, Kryssie said:

Hi! So is that a total of $1225 for the whole AOS package? And to confirm it again, you only submitted one G-1450, for the AOS, EAD, and AP right?

Thanks! 😇

No, I think I paid $1,760 (off the top of my head, please confirm this number), but yes, only one G-1450 for the entire thing. I did not file for AP though

-

On 5/7/2019 at 4:02 PM, Villanelle said:

Sorry it took me a while to get back to this.

MIL needs to fill out the 864 and if they file joint taxes make sure you only enter MIL income and show their tax return with w2s clearly showing which part of the joint income tax return is hers. FIL does not need the 864a - however they can ask for it. MIL is the only joint sponsor UNLESS you want to add FIL (he would be second sponsor and use the 864a. Your list looks fine. Have you discussed with the family about how the taxes will be done next year? (If your wife -and even if you- are going to still be listed as their dependents /they file head of household. It would be a big tax break for them but you will end up paying significantly more.

No worries, thank you so much for you help again! My interview has been scheduled in the meantime, so everything seemed to have been correct

I did end up including a 864a filled out by FIL. Yes, I indicated MIL as the only joint sponsor on the form.

Regarding the taxes, as it turned out, my wife actually wasn't listed as a dependent on her parents tax return for 2018.

// I answered the questions in case someone faces the same problem in the future and comes across this thread.

-

Good Morning,

I'm having my interview early July and currently getting ready for my medical exam.

The Form I-693 found here https://www.uscis.gov/i-693 expired on February 28, 2019. However, there doesn't seem to be a new and up to date version of the form available.

Under Edition Date, it just says:

Quote"10/19/17. A new edition of this form is coming soon. In the meantime, you may file using the 10/19/17 edition. You can find the edition date at the bottom of the page on the form and instructions."

But that was from way back in 2017.

So I should be good using the form expired earlier this year?

Just don't want to risk using an expired form for my medical and seeing a new edition being released after my medical but before the interview.. 🤔

-

On 4/27/2019 at 8:48 PM, username_taken said:

Did you ensure you calculated household size correctly of 2 if it is just you and your spouse and not 3? Many people make that error. If you decide to go with a co-sponsor- if mother in law does not live in the same house she would fill out an 864 as the co-sponsor.. If MIL is married and you are using FIL income as well FIL will fill out an 864a. Many people send in the 864a for the other parent even if it is not required because often it is asked for to be sure the spouse knows the obligations being undertaken by the other spouse.

Yes, the calculated household size was 2.

We have decided to go with MIL as a co-sponsor. She does not live in the same house. MIL is married, but her income exceeds the 125%. They do, however, file taxes jointly - that doesn't matter though right? So it is not necessary for FIL to also fill out a I864 - only a I864A correct?

I have two more specific questions regarding the I864:

-

Regarding the household size:

- Yourself: 1

- If currently married: 1

- Dependent children: 2 (there are 3 children. My wife and 2 young kids)

- Other dependents: 1 (My wife, who was claimed as a dependent on 2018's tax return)

- Household Size: 6 (including me, the immigrant)

Does that look correct?

-

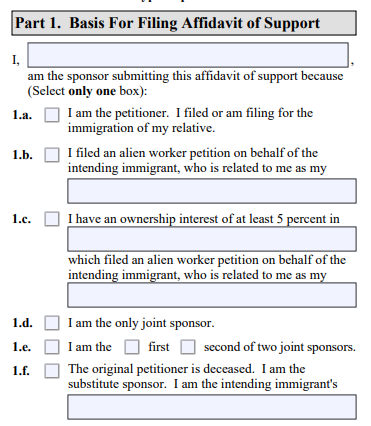

Regarding the first Part of the form:

- Is MIL now the only joint sponsor (1.d), or one of two (1.e) since we have already sent in a I864 filled out by my wife (which was rejected, thus RFIE)?

Thank you so much, again!

-

Regarding the household size:

-

Hey guys,

Just when you think you're done with this tedious process, you're hit with a "Request for Initial Evidence" in the mail. It is regarding the I-864 (Affidavit of Support).

As advised here, I-864 Questions regarding meeting 125% poverty guideline, since my U.S. wife only made $13k in 2018, I filled out the form I-864a and included a letter from my employer including my personal information, employment status, salary (around $40k), and that I will continue to work for them pending my AOS status. Unfortunately, that didn't seem to have been good enough.

I now have a few questions in regards to responding to the RFIE and including my U.S. wife's mother as a joint sponsor (who makes more than 125% of the poverty limit).

In the letter, there are a few bullet points, which makes me think there have been a couple of errors.

The first bullet point says:

• Submit all supporting tax documentation (W-2s, 1099s, Form 2555, and all supporting tax schedules) submitted to the Internal Revenue Service for the most recent tax year. The petitioning sponsor must submit all supporting documents tax documents for the most recent tax year.

In that case, my U.S. wife is still the petitioning sponsor right? Or would that now be her mother (joint sponsor)? In the original package, we included my wife's 2018's W-2 and 1040 as well as my own W-2 and 1099s and 1040.

The second bullet point says:

· Based on the documents submitted with Form I-864, Affidavit of Support, for the petitioning sponsor, the income did not meet 125 percent of the federal poverty guideline for the petitioning sponsor’s household size. See Form I-864P for information on the Federal Poverty Guidelines. Obtain a qualifying joint sponsor who demonstrates the ability to support you or submit evidence of assets. See Form I-864 Instructions for more information. If you decide to obtain a joint sponsor, you will need to:

- Submit a completed and signed Form I-864, Affidavit of Support, from the joint sponsor. All pages must be present andof the latest edition date.

- Provide the joint sponsor’s Social Security Number on Form I-864.

- Provide a complete and correctly calculated household size on Form I-864.

- Submit a complete copy of the joint sponsor’s Federal income tax return and all supporting tax documents (W-2s, 1099s, Form 2555, and tax schedules) for the most recent tax year.

- Submit evidence of the joint sponsor’s status as a United States citizen.

This seems pretty straight forward, my wife's mother will fill out the I-864. Would she be the (Part 1) "only joint sponsor", or the "[ ] first [ ] second of two joint sponsors"? Basically, would my wife's mother replace my wife's I-864 with her $13k or would that just be an addition?

Regarding the household size: how does that work for the section under "Persons NOT sponsored in this affidavit:"?

Thank you guys so much!

-

3 hours ago, Karla1985 said:

Hey! USCIS customer service told me to pay for I-485 and I-130 with two separate forms. What I forgot to ask is how to place those forms. Both of them on the top of the whole AOS package or each of them on the top of the application we are paying for?

Thanks!

I just submitted one G-1450 for my entire AOS package and put the form either on the very top or just behind the notification form. The transaction showed up 3 or 4 days after they received the package and everything was find

-

18 minutes ago, Lil bear said:

EZ requires that the petitioners income alone is sufficient. So if you are needing to add yours with hers, she will use 864 and you will complete 864a

perfect, thank you so much!

-

15 hours ago, eckoin said:

Nope! Just make sure your job letter is on your company's letterhead and signed by HR, your manager, or whoever normally signs these letters.

They should include: your name, your current position, your current employment status, your current salary (if not salaried, then hourly rate + hours expected per week = total expected income for the year), and that they will extend your employment pending your permanent status application. Signed, and that's that. Good luck!

I have now received a letter stating all of the things from your quoted post. In that case, do I have to fill out I-864EZ since there doesn't seem to be a space to include my (alien relative) income?

-

17 hours ago, eckoin said:

Yes, if you meet the following criteria:

1. You're working legally - you'll show proof of your F1 OPT for this.

2. You have a letter from your employer stating that you're earning $X per hour for Y hours per week, for a total of $XY per year, and that this income will continue if you're granted permanent resident status.

Thank you so much for your detailed response!

I do meet these criteria. Is there a specific form I have them fill out, or is a simple word document stating all those things including their signature sufficient?

-

Hi guys,

I am currently working on the I-864 form and we're struggling to complete it.

My U.S. spouse currently only works part-time because her employer pays for her to go to school full-time. In May/June, after graduation, she goes back to full-time making $15/hour ($31k annually).

Her W2 2018 income was only about $13k, because of her part-time status.

The 125% poverty guideline for 2019 is around $21k, right?

Does she has to meet the 125% for every year in the past 3 years?

I'm working as well in the U.S. (F1 OPT) making $15 an hour full-time, which is around $31k/year. Can I add my income, too?

I see that if the household income doesn't exceed the 125%, she can include her checking and savings balance. Would that just have to add up to the 125% including the $13k from her 2018 W2?

"My total income (adjusted gross income on Internal Revenue Service (IRS) Form 1040EZ) as reported on my Federal income tax returns for the most recent three years was:"

Is that the same amount as in field 1 of her W2's?

Regarding "Sponsor's Household Size": We currently live in a house with one roommate. Do we have to include that roommate in the form?

Sorry for all the questions, and thank you guys so much for your help. Completing the files hasn't been too stressful, but this particular one is freaking me out lol

-

20 hours ago, K1visaHopeful said:

Ask friends/family too? They might remember too.

I was able to narrow it down a little more, but it would still be a best guess. The user 'Paul & Mary' from above said month/year is good enough. Is it better than a best guess, in your opinion?

-

21 hours ago, K1visaHopeful said:

Best guess or check your FB for updates for "yay new place" or your bank statements for setting up utility bills/paying damage deposit?

Unfortunately, I've never used FB like this. I did try to check my bank statements, but it would let me go back only a couple of years (the address change was in 2014)..

-

I cannot figure out the date of one of the addresses when I moved from one place into another. I have the month and year. Is that good enough or should I put in my best guess?

-

@K1visaHopeful super helpful, thanks so much!

-

Good Evening!

I am currently working on filling out my I-130A form and have a couple of questions regarding both the address and employment history.

For context, I am a German national currently on F1 OPT in the U.S.

I have 9 different addresses for the past 5 years, so I have to utilize "Part 7. Additional Information" to list them all.

In the Part 7 section, it asks to indicate Page Number, Part Number, and Item Number.

Since it is additional information to the Address History (Part 1 Information About You), Page Number and Part Number are obvious. But what about Item Number? Since I am not providing additional information in reference to an address I listed above, but rather adding an entire new address.

And do I simply just put the address into the text box (i.e., line 1 street name, line 2 city + state + zip, line 3 country, line 4 dates)?

Also, my permanent address has been and is my German home address throughout the entire time; for "Date To (mm/dd/yyyy)" is it correct to indicate "Present"?

Does this work the exact same way with my employment history? (11 positions in the past 5 years, including part time and summer jobs)

Thank you guys so much!

Why wouldn't you file for citizenship?

in General Immigration-Related Discussion

Posted

I've been going back and forth on whether to file or not to file for a while now, and that's one of the main points.

That, and the whole 'Pledge of Allegiance' thing honestly.