RobpalermoFR

Members-

Posts

46 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Everything posted by RobpalermoFR

-

Regarding originals of NVC documents

RobpalermoFR replied to mico1989Athens's topic in National Visa Center (Dept of State)

i am also trying to find out this answer, on this forum i saw so many mixed answers embassy doesn't specially ask for it but it only says "bring originals of documents uploaded to ceac" but i don't know if they mean applicant or everybody. do we need to bring ALL originals of petitioner's documents too? Some documents are only digital but i don't want to mail my naturalization certificate, will that be a problem? please let me know if you ever find out an answer.. -

Hello, my spouse has an interview coming up for CR1 visa abroad. I am in the USA. In the interview email sent from embassy, it says "originals of copies" must be with my spouse at the interview. I am confused if I need to physically mail original of my naturalization certificate, passport or divorce documents(I was previously married). We uploaded these to NVC before the interview. Is it okay if I scan the certified/original divorce document and email to my spouse? Thank you.

-

thank you for answers!!! but please understand my question: of course my spouse knows about my past. of course she knows i had a divorce, i didn't have kids. but i am asking: does my wife need to memorize all details like: where i met my ex how i met my ex when did we get married where did we get married why did we get divorced i don't even remember some of this top of my head, if you can clarify it for me, i will appreciate.

-

Thank you folks, i want to clarify something in case i was not clear.. of course my wife knows about my divorce, and we have nothing to hide. i'm just asking if my wife needs to know (by heart) date of my previous marriage, date of divorce, full name (first and last) of my previous wife. like as if she is in an exam. Or how we(I and my previous wife) met, how i met my previous wife, where we lived with exact dates.. does she(my current wife) really need to memorize all this? thank you if you can clarify this.

-

Hello, i am not sure if this topic was discussed i apologize for asking it again.. my wife has an interview at consulate in her home country. I am the petitioning US citizen. I came to US as a worker in 2000 and married a US citizen (not fake) which lasted 9 years. I naturulized years ago. I will send my official divorce papers to my wife to bring to the interview. We already submitted it to USCIS and NVC. This is a sensitive topic for some families but does my wife need to know all details (like my previous wife's name, date of previous marriage, how long i was married, why I got divorce, where I got divorced etc)? Will they ask her about my past marriages?

-

Hello, i'm at last step of submitting documents but i am confused about one last part. Can you please tell me where to upload proof of domice for the "PETITIONER, US CITIZEN". Does it go under option section under civil documents for beneficiary or Additional AOS Supporting Documentation for petitioner? thanks.

-

Hello, I know that we need to upload 1 passport style photo of beneficiary in CEAC portal. However there is absolutely not one required for us. Is this normal? I watched tutorials on youtube and people had a pre-defined item to click and upload a photo however in our portal, we don't have any photo listed in civil documents. We only have: birth certificate, passport biographic page, marriage certificate and police certificate. Can someone help me understand if this is normal?

-

thank you so much, so we can upload, delete, re-upload until submitting anything. my last question: i am the petitioner. i had a divorce 10years ago and i have my divorce papers. where do i submit my divorce papers? under civil documents of my spouse? only section for petitioner (us citizen) is related to financial support stuff. thank you.

-

hello, we are ready to upload our documents at ceac stage. i have a document that i want to upload but i might need to update it (with a better copy) in the future before submitting our documents. is the system allowing us to delete or update any file/document? (such as marriage certificate in pdf) or once it is uploaded, it must be submitted? i am asking if a document can be removed or updated BEFORE submtting. thank you

-

thank you for reply. yes, it is stressing me but it is because i am anxious and don't want to cause RFE. Can you please reassume me? 1 - if i only include full time w2 job, and not list "freelancing", it doesn't mean i had that income illegally right?(i just don't want them to assume it is the case if they see it on my tax returns) 2- I saw someone else posted and said it is mandatory to include all incomes? (because i also had 1099 from a bank for interest) i just think my w2 should be enough because it is well above the limit, so not reporting my freelance income (i am us citizen and i paid taxes on it) shouldn't cause an RFE? THANKS

-

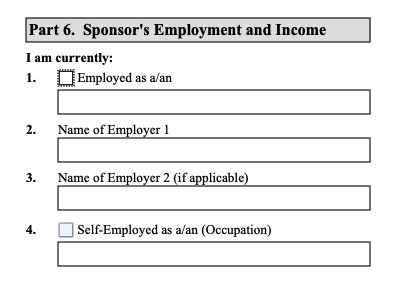

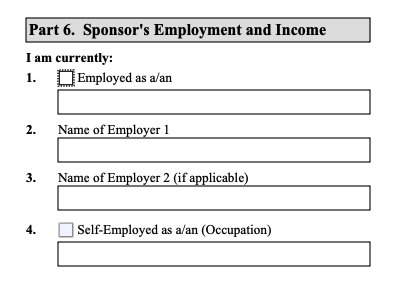

i have W2 and 1099 at the same time. my w2 is well above the income limit (about 80k) my 1099 is only 2k. my question: is it okay if i only check "employed" box, and not check "self-employed" box. and not submit 1099? in other words, is it okay if i only report w2 job becuase it is well over limit and it is sufficient number. note: i paid taxes on 1099 (2k) and it is in my tax transcripts. does anybody have a suggestion for me?

-

hello all, i found this when i was researching my problem. i posted it here but i got no replies. any of your help is greatly appriciated. my question is: I am the sponsor for my spouse. We have only 1 beneficiary and 1 sponsor on form I-864. I am the US citizen and I have a W2 full time salaried job that pays me 87K a year. I have my W2 and tax transcripts. I also have a freelance job that paid me 2k last year, i got a 1099. I am not sure if i should submit that 1099 and mark "self-employed" box AS WELL AS employed box. my employment income(w2) is well enough for sponsorship. Is it okay if I just check "employed" and not check "self-employed" and only display my W2 income? Is it okay if I just share my W2 full time employment, and not mention the small 1099 I had? Note: I always paid taxes for 1099, they are in the tax transcripts. please help me with this, and thank you in advance for any help you can provide.

-

Hello, i can't find support for my problem, i might have posted it under wrong place. I am full time salaried (w2) sponsor for my spouse. no joint sponsors or kids. my w2 is enough to be sponsor. i am also self employed (just freelance stuff) and i had 1099 for 2k last year. i paid taxes etc. is it okay if i check ONLY "employed" box on form i-864 and not mention self employment? since my W2 (and tax transcripts) are enough to cover sponsorship, is it mandatory to include small 1099 i received? Note: i paid taxes on 1099, and it is in my tax transcript. but majority of my income (over 80k) is from W2 and i will include that. i put a screenshot of part i am referring to. any help is appreciated.

-

Hello, I am the sponsor for my spouse. We have only 1 beneficiary and 1 sponsor on form I-864. I am the US citizen and I have a W2 full time salaried job that pays me 87K a year. I have my W2 and tax transcripts. I also have a freelance job that paid me 2k last year, i got a 1099. I am not sure if i should submit that 1099 and mark "self-employed" box AS WELL AS employed box. my employment income(w2) is well enough for sponsorship. Is it okay if I just check "employed" and not check "self-employed" and only display my W2 income? Is it okay if I just share my W2 full time employment, and not mention the small 1099 I had? Note: I always paid taxes for 1099, they are in the tax transcripts. please help me with this, and thank you in advance for any help you can provide. Rob&Michelle