-

Posts

4 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Posts posted by NorthernKeys

-

-

35 minutes ago, seekingthetruth said:

You still have to report all interest, even if you don't get a 1099.

The benefits of filing jointly far outweigh the minor interest you need to report.

How do we do that if we haven't received any relevant forms? Should we just carry on from the point we reached above entering what information we can?

-

53 minutes ago, Wuozopo said:

Report the interest where you report US interest— Schedule B and then Form 1040 Line 2b for the total of all interest. It is taxable.

Thanks for the info!

I'm probably missing something super obvious, but how can I access this on TurboTax?

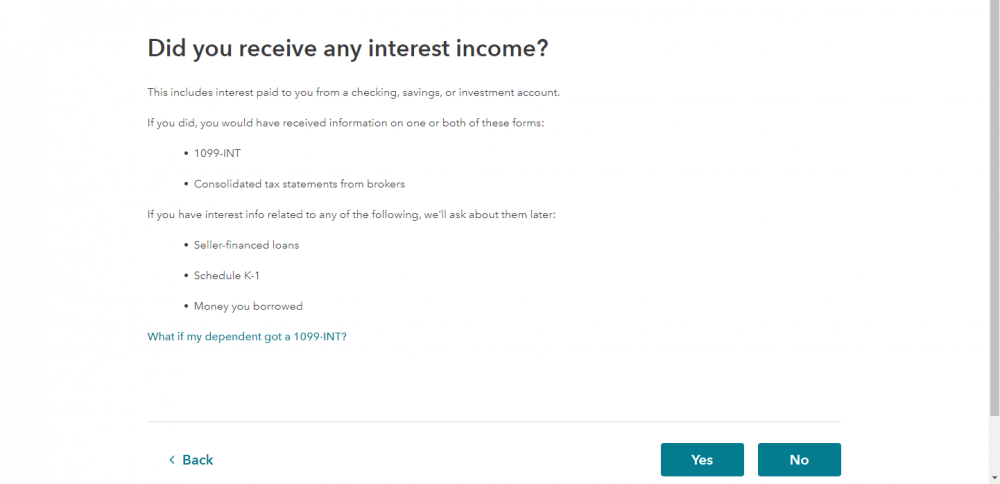

After typing in "Schedule B" to the search box and following the directions it mentions, it brings us to this page:

Neither of us have received anything related to 1099-INT or tax statements from brokers. The other interest info points below are irrelevant to our situation too, I believe.

With the interest earned resulting from and being deposited into my UK bank account, where should this be counted? I haven't earned any interest from US accounts, or any other income at all for that matter.

-

My wife (US Citizen) and I (UK Citizen, AOS pending) are currently looking at filing taxes as "Married Filing Jointly" for the first time. One thing in particular that's confusing us is how we should deal with my bank account in the UK.

At the moment, judging by the current exchange rate, the value of my bank account is a tiny bit over $10,000. Does this mean I will have to file the FBAR form to go with it?

Also, I earned a very small amount of interest in my bank account over the last year (less than £20), but I received no other income throughout the entire year. Does this also have to be reported, and if so, what would be the best way of doing it?

I already have a social security number, and have been in the country since last January, so I'm fairly certain I cover the residence requirement.

We're using TurboTax to go through this process, if that helps.

Thanks in advance!

Filing taxes "Married Filing Jointly", how should I deal with my UK bank account?

in Tax & Finances During US Immigration

Posted

That's good to know. We were thinking we'd need a proper form in order to do this. I'm used to everything else requiring proof or evidence, so that makes it easier that this seems to not require that. Thanks!

I'm currently living in the US and have been doing since last January. Other than that little amount of interest in my UK account, I haven't had any income in either country. Since I've been here that long, have a social security number, and we're married, we're assuming it's ok for us to file jointly.