WorldTravelers

-

Posts

297 -

Joined

-

Last visited

Content Type

Profiles

Forums

Partners

Immigration Wiki

Guides

Immigration Forms

Times

Gallery

Store

Blogs

Posts posted by WorldTravelers

-

-

This year would be the first time my mom would file her taxes, so this is all new to us.

She is a resident since Dec 2013. She doesn't have any income (just some bank interest), so she doesn't HAVE to file. But, she is filing so that she has a proof of US residency when it comes the time to apply for citizenship, and as a proof of income for the healhcare tax credit (premium subsidies) - which she received for this year.

She lives with me, but I am NOT claiming her as a dependent on my tax return. She doesn't pay me rent or any other expenses.Can she claim herself under exemptions on tax return? The tax form says NOT to check the box next to Yourself "if someone can claim you as a dependent".

-

Green Card in hand, 63 days after POE.

-

09/19/13- ELIS paid

12/14/13- POE Houston

12/23/13- SSN card arrived

02/06/14- ELIS: Circle: Optimized, Status: In Process

02/07/14- USCIS status: Initial Review

02/10/14- USCIS status: Card Production

02/13/14- ELIS: Circle: Closed, Status: Card Produced

02/15/14- green card expected to arrive

-

Gud luck man

Thanks (from a woman!)

uscis.gov shows our case today!

-

Our ELIS status changed to Optimized today!

I sent another email to TSC just yesterday asking to check why our case is not in the database. It's nice having a feeling like our little efforts make some difference in this process.

Still can't check the receipt ID # on the uscis.gov

-

Today my card production status change from accepted to optimized

POE date 14 Dec 2013

Cool!

Did you end up going to or calling the POE?

Did you get an email notification of this status change?

-

Yeah... Ill wait for 1 week more if status not change to optimize ill go to airport immigration office

From what I understand, the cases are processed at the Texas Service Center, not the POE immigration office.

You think they might help you at the airport?

-

This is same case like me

Fee paid 9/30/2013

POE 12/14/2013

POE port houston

Contact USCIS and they email me same msg which u get

Ha, maybe we were even on the same plane coming to Houston!

-

Um, 24 Dec to 28 Jan is not 45 days? Is your POE date correct above?

Sorry, it was a typo. Corrected it.

-

09/19/13 - Fee paid

12/14/13 - POE

01/13/14 - emailed ELISHelp about status

01/14/14 - USCIS responded that TSC will contact me

01/28/14, today (exactly 45 days after POE) I received this response:

A search of USCIS records indicates your Immigrant Visa Fee has been paid. However, after a thorough search, the Texas Service Center is unable to locate a record for you in our electronic systems based on the information you provided. The Texas Service Center has recently implemented a new database to track these cases and provide better customer service. The process of moving from one database to another has caused a slight delay. We hope to have this delay corrected as soon as possible. If you do not receive your Permanent Resident Card within the next 90 days, please contact customer service.

Any advice on what to do next, aside for wait 90 days?

-

When they say "45 days", is that calendar or business days?

-

Thank you all for the responses!

I called CBP at IAH and was told that for Saturday afternoon I can expect 1.5-2 hours from the time the plane lands to the time she exits. They also confirmed it would be at Terminal E.

I found here pretty good map of Terminal E that shows flow of traffic and has visual indication of "Passenger Greeting Area". That's what we were looking for!

I booked a wheelchair for my mom, and they usually take her through the passport control all the way to the baggage claim. So she would just need to clear the customs and walk through that glass sliding door....

-

My mom is arriving as a new immigrant this Saturday to Bush Intercontinental airport (IAH). That will be her POE and final flight, but neither of us is familiar with that airport. Since she speaks very little English to ask her way around, and doesn't have a cell phone, we wanted to make sure we know exactly where to expect each other.

I checked the same flight as hers this week, and it has been arriving to Terminal D. I already explained to her the layout of that terminal D, and we have a backup plan on where to wait on that terminal main level if we miss each other.

Now I am finding out that immigration and baggage claim would actually be on terminal E?!

Have any of you been through this POE recently and can confirm where the exit is, terminal D or E?

Is there more than one glass sliding door where one can exit after customs?

-

I just study the Receipts from USCIS ... I tried to change the last last two digits of our receipt number

Don't pay too much attention to nearby numbers. NBC creates over 30,000 MSC case numbers EACH WEEK, and about 1/3 of those are I-130 petitions.

-

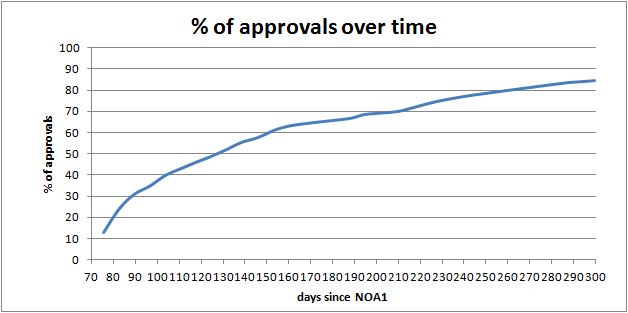

As sad as it is, there are still about 1400 mid-December cases, or 15%, waiting on approval.

(Data from USCIS case status site)

-

If it's means-tested, it wouldn't be calculated, though, would it? Seems self-contradicting. I'd like to ask what your source is for that.

I am sorry, but I don't understand what you are asking here; about does it matter if immigrant lives with the sponsor or not, or about is tax credit means-tested benefit?

I've visited so many sites recently, and didn't save all the links. Not all were for ACA, but after talking with healtcare.gov support people they basically said the income is calculated in the same way as for other government benefits, based on household income. But here is at least one place where it's mentioned that the sponsor's income is included in the calculations even if the immigrant doesn't live with the sponsor:

" the resources and support from the sponsor are considered in their initial eligibility determination. This is true regardless of whether an immigrant lives with the sponsor in the same household."

http://www.stc-law.com/immigrants/immigrant-eligibility.html

This is SSI benefits, same is for medicaid I believe.

The healtcare.gov folks also told me they always use household income when determining eligibility.

And from 864 form: sponsor's income is considered to be available to the immigrant when determining whether he/she is eligible for certain federal means-tested benefits.

I know I said I am not 100% sure that premium tax credit is not means-tested benefit - but I am 'pretty' sure it's not.

And another clarification, I never talked about means-tested benefits of the sponsor being included in the sponsor's income - that would be a contradiction. If that's where the confusion was, you are right - any means-tested benefits would not be included in calculating the income.

-

Ok, I called a few of Tier 2 Officer and they all said the same thing. "they don't know where my case is at beside it's still in NBC." Does this mean, my parents case is still sitting in NBC and hadn't been touch? thx

Ok, so they don't see that it was transferred to a local office. Then it's probably still at NBC.

I haven't really been following up on this, but it seems that there has been some change in procedures again, and that may be why the processing times are longer.

Apparently, there is a new NBC processing center in Overland Park, Kansas, and all I-130s since May have been on hold sitting at that new center that opened on Sep. 28th.

You can look up more info about it on this forum...

-

Kako vidim na vasem timeline-u vise vremena je trebalo da USCIS proslijedi peticiju do NVC, nego sto se ista zadrzala u NVC.

Jel to obicno tako ? Pretpostavljam da NVC rijesava sve brzinom kojom im mi dostavimo potrebne dokumente, jer nemaju nekog razloga da razvlace...ili ?

Taj dugi tranzit ne bi trebalo da bude uobicajen, al kad smo mi prolazili kroz to bilo je 'dosta' ljudi ovde na forumu sa slicnim problemima.

Na tom linku mozes naci NVC Processing Times Spreadsheet i tamo vidjeti koliko obicno prodje vremena od NOA2 do kada NVC primi papire (mada je tu cesto uracunato koliko treba da dobijanja broja slucaja, sto je jos jedno 10ak dana). Sam transfer ne bi trebao da bude vise od 7-10 dana.

Kao i kod USCIS, NVC ima neki "queue" gdje primljeni slucajevi stizu i odakle uzimaju da rade na njima - prodje neko vrijeme nakon sto prime papire prije nego ih obrade. Na srecu, puno brze to obavljaju!

-

Are you saying that they can buy insurance on the exchanges, but the affadavit of support blocks their getting any kind of government benefit to cover the cost? They current each get a small pension check from Russia - about $500 a month each.

Yes, LPRs are able to buy insurance on the exchanges now. I am still not 100% sure that tax credit on federal tax return is not federal means tested benefit. But lets say it's not - AOS is not "blocking" them from getting subsidy per say, but that income is taken into household income when calculating their eligibility.

Even if the immigrant doesn't live in the same household as the sponsor, that income is still calculated. So, if the household income is above 400% of FPL (depending on the family size), they may not qualify for any premium tax credit. And the credit is higher for those closer to 100% than for those closer to 400%.

They can get subsidies to cover the cost of insurance on the exchanges. No problem.

This is true only if the household income is under 400% of the poverty level for that family size.

For us, for example, my mom would not qualify for tax credit, but would still have to pay over $630 a month in premiums for basic coverage on the exchanges. Not cool.

-

Luk,

Posto si proaktivan i zelis saznati informacije unaprijed, preporucujem ti da prostudiras ovde NVC Filers - <month> 2013 forume. Za svaki mjesec ima novi, evo jedan za Juli

http://www.visajourney.com/forums/topic/439000-nvc-filers-july-2013/

Tu imaju linkovi o NVC procesu, kako sto brze proci kroz tu fazu, i isuskstva drugih.

Npr, taj DS-3032 se moze poslati emailom. Naravno brze stigne i brze bude odobren. Na tom linku gore imas za link za 3032 email template.

Ako ipak preferiras postom, jeste supruga to treba da posalje, al moze ona to i unaprijed popuniti, tebi poslati, pa ti odavde da saljes kad bude vrijeme. Opet brze nego da ona iz BH salje direktno na NVC postom, osim ako ne koristi DHL i sl. Naravno, postoji mala sansa da bi NVC promjenio taj formular sto ona sada isprinta... ja opet preporucujem email.

Sto se tice velicine papira, jeste, kod nas A4 format je malo veci. Nema veze. Saljes te originale kakvi jesu (od suda npr je papir pola A4 formata). Samo pazi kad kopiras (jer trebas i kopije slati) da sve uhvatis na kopiji.

Sretno!

-

Thank you for those links. Lots of information but sill not all facts are known. The last time I talked to someone from healthcare.gov, since their website doesn't an answer to one of my questions, he told I can always go and read through the actual law to find the answer! Seriously?!

Here are some things I confirmed:

- LPRs are required to have insurance (US insurance, not from home country), and can apply for Marketplace plans. This is not considered means-tested benefit.

- If the household MAGI (modified adjusted gross income) is between 100-400%, they can apply for premium tax credit, in advance or on tax return. Still didn't confirm 100% if this credit is considered means-tested benefit or not; a no-no for immigrants with affidavits of support.

- Most marketplace plans should also cover seniors who are not eligible to purchase Medicare (very few fall into this category), and they are not allowed to charge them more than 3x what they charge a 21-year old. The actual prices are no available until you file an application, but based on the Kaiser calculator on the above website, which gives estimates for the Silver plan, our MAGI would be just above 400% of FPL, but the premium would be over 11% of household income.

- LPRs also pay penalty if they don't have insurance, unless they qualify for an exemption. The penalty is calculated on their tax return, based on their MAGI (not household). They are exempt from the penalty if they "don't earn enough to have to file a tax return" - this is determined by IRS, under "who has to file", and that is determined by the individual's AGI, not household.

Also, they are exempt if the lowest-priced coverage available would be more than 8% of household income. I don't know how much the Bronze plan would be, but the silver for us is above 11% of income.

- Federal Medicaid is still not available to LPRs, and TX doesn't have any state medicaid.

- the short term travel insurance is not affected by Affordable Care Act; they can still have lifetime maximum limits, charge what they want, and deny based on pre-existing condition.

Just sharing the information.

-

I would call and talk to another Tier 2 officer. Once you get the same response from 5 officers, then you'll know you have the correct answer. Try calling late in the evening (I think they are open until 8PM) for shorter wait times.

They CAN see if the case has been transferred to a local office. Some officers just choose not to share the information.

It may not have been transferred, in which case they should tell you they don't see that it was transferred, but not that they don't know if it was.

The service requests can take couple of months to get a response to. Not useful.

Cases are usually transferred within the first couple of months after filing. Then they sit there until that office is ready to review them. How they choose in which order to work on files is not clear. It's obviously not in the order the cases are filed.

There is really not much you can do to speed things up. If you really want to know where you case is, you could try contacting your congressional liaison (search for it here on VJ). They have contacts at local offices and can check if your file is there.

Best of luck!

-

I'm just clueless of what to ask so they can at least gave me something related to my case.

Ask to speak to Tier 2 officer and then ask if your case has been transferred to the local office and when. Most MSC cases are processed at local offices. The officer should be able to find what the local office is based on your zip code, but you can also find it on USCIS we site.

USCIS has volume charts for each local office, so you can get some idea how busy they are. You usually can't call into the local office directly, but you can setup an info pass to that office and go get some answers in person.

-

I don't know, the health exchanges are up. Have you looked at them?

I am just starting to read up on this. It's confusing. Do you maybe have some good links to share on health exchanges?

I found out that in my town we'll have two "enrollment supersites" staffed by certified navigators open next week, with free help available, so I might go there for some answers. Hopefully these folks are also trained to answer questions related to immigrants.

Can my mom (new resident) claim herself under exemptions on tax return?

in Tax & Finances During US Immigration

Posted · Edited by WorldTravelers

Thanks for your response.

I was not clear on that because it says "if someone CAN claim you" to not check the box for yourself.

The instructions on determining if one can be claimed were not clear to me either. She lives at the same address, but I would paying the same bills even if she was't here. Sure, I pay for the extra food, but she doesn't have any fixed expenses I could show I am paying for HER. Which of course I do cover her expenses because I sponsored her to come here.

She is filing with that "Yourself" exemption checked, income/tax/return $0, so hopefully it won't trigger an audit.